European commercial real estate investment slumped to an 11-year low in the first quarter of 2023, led by the office sector as uncertainty over pricing and the higher costs of mortgage finance weighed on sentiment, according to the latest Europe Capital Trends report from MSCI Real Assets, a part of MSCI.

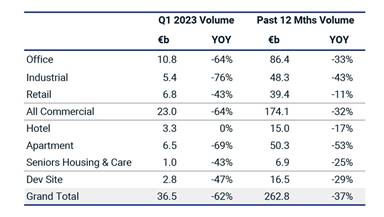

The volume of completed transactions fell 62% from a year earlier to 36.5 billion euros in January through March with most of the major real estate sectors and national markets down, the report showed. Offices, Europe’s largest real estate sector, had the fewest number of properties sold on record in the quarter and the 10.8 billion euros of transactions was the lowest in 13 years.

Tom Leahy, Head of EMEA Real Assets Research at MSCI, said: “The disparity in pricing expectations for buyers and sellers has widened since the second half of last year as appraisal values continue to adjust to the rapid rise in interest rates and on concerns over the muted economic outlook. The office sector has also been particularly hard hit as changing occupier needs, such as the switch to hybrid working and a focus on energy efficiency, means a bias towards better quality assets has emerged.”

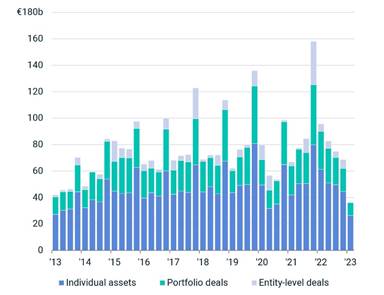

Quarterly investment volume by deal type

The industrial sector had the quarter’s sharpest annual drop in investment sales among the major property types, with 5.4 billion euros of transactions. The 76% decline was a significant reversal of fortune for a sector which had attracted strong investment flows and price gains after the COVID-19 pandemic highlighted its importance to supply chains and e-commerce.

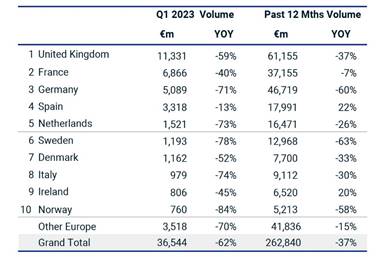

The U.K. remained Europe’s largest commercial real estate market with 11.3 billion of investment activity, a 59% decline from a year earlier. France, Germany, Spain and the Netherlands ranked next in the top five markets, in order of size. While almost every European country had falling transaction volumes, France and Spain notably fared less badly due to local property sector trends, with annual declines of 40% and 13%, respectively.

Paris overtook London to become Europe’s top investment destination thanks to the three largest single property sales of the quarter. These included luxury retailer Kering’s 860 million-euro purchase of 35-37 avenue Montaigne and the 836 million-euro forward purchase of a new headquarters in the 13th arrondissement by Groupe AFD, the French government’s overseas development agency. Overall transaction volumes in Paris were unchanged from a year earlier at 5.3 billion euros.

Property sales in Spain totalled 3.3 billion euros, supported by transactions of apartment blocks, notably in Madrid, and as the post-pandemic revival of tourism supported investor demand for hotels. Barcelona was the only top 10 European city to enjoy investment growth, largely the result of the 180 million-euro sale of the Hotel Sofia to Axa’s joint venture with Blasson Property Investments.

Investment volume – sector summary

Tom Leahy concluded: “While there are obvious concerns about the availability of real estate finance following the banking turmoil in March, we’ve yet to see a widespread increase in distressed sales. For the market this is limiting scope for any dramatic shifts in transaction pricing. Anecdotally, lenders appear to be accommodating in the current environment and it’s worth remembering that after the Global Financial Crisis it was several years before we saw meaningful volumes of distressed sales.”

In Germany, the Q1 Europe Capital Trends report highlighted:

- Investment volumes declined 71% in the first quarter from a year earlier to 5.1 billion euros. It was the weakest level of activity since 2010

- Germany was Europe’s third-largest market behind the U.K. and France

- The quarterly decline was driven mainly by more than an 80% decline in office transactions and a 75% fall in sales of multi-family residential assets

- Madrid pushed Berlin into fourth place in terms of Europe’s top investment destinations, a ranking led by Paris and second-placed London. Transaction volumes declined 50% to 1.2 billion euros for the German capital

In the U.K., the Q1 Europe Capital Trends report highlighted:

- Investment volumes fell 59% in the first quarter from a year earlier to 11.3 billion euros

- London slipped into second place as Paris was the quarter’s top European investment destination. The British capital recorded 4.8 billion euros of property sales, 58% lower than a year earlier

- The quarter’s largest completed single asset transactions in London were CDL’s 448 million-euro purchase of St Katherine’s Dock and Lazari Investments’ 483 million-euro purchase of the Fenwick department store and neighbouring buildings on New Bond Street

- The U.K. was Europe’s top national market for investment, supported by sales to domestic investment managers and developers. U.K. offices, apartment blocks and industrial assets were the top three asset types targeted by cross-border investors

- There were 53 London office sales competed in the first quarter, the lowest number for a quarter on record

In France, the Q1 Europe Capital Trends report highlighted:

- Investment volumes declined 40% in the first quarter to 6.9 billion euros. Despite the decline, France moved ahead of Germany into second place behind the U.K. in the ranking of Europe’s top national investment markets

- Europe’s three largest single property deals in the first quarter were all in Paris. The two largest were office transactions: luxury retailer Kering’s 860 million-euro purchase of 35-37 avenue Montaigne and the 836 million-euro forward purchase of a new headquarters in the 13th arrondissement by Groupe AFD. The third largest was Dubai Holding’s 650 million-euro acquisition of the Westin Paris Vendome hotel

- Investor demand for Paris offices has been robust relative to office markets in central business districts elsewhere in Europe, accounting for more than 4 billion euros of transactions. These include Allianz’s 245 million-euro forward purchase of the Inspire property

In the Netherlands, the Q1 Europe Capital Trends report highlighted:

- Investment volumes declined 73% in the first quarter to 1.5 billion euros, placing the Netherlands as Europe’s fifth largest country market in the quarter behind the U.K., France, Germany and Spain, respectively

- Amsterdam ranked 14th in Europe’s top investment destinations as volumes declined 78% to 309 million euros

In the Nordic markets, the Q1 Europe Capital Trends report highlighted:

- The Norwegian, Swedish and Finnish markets all posted more substantial declines in deal activity than the average for all of Europe

- Sweden ranked in sixth place among national commercial real estate markets in the first quarter. The 1.2 billion euros of transactions in the first quarter was 78% less than a year earlier

- Stockholm was Europe’s fifth biggest investment market even as transactions dropped 63% to 826 million euros. Apartment building sales in the capital fell to a nine-year low in the first quarter

- Norway suffered an 84% drop in investment to 760 million euros with Oslo accounting for roughly half of property sales

Investment volume – country summary

Europe Capital Trends data based on office, retail, industrial, hotel, apartment, senior housing and development site properties and portfolios 5 million euros and greater unless otherwise stated. Data believed to be accurate but not guaranteed.

Source of the report and data should be noted as MSCI Real Assets. MSCI Real Assets is a part of MSCI.

Source : MSCI

Le mie ricette per la real estate community

Le mie ricette per la real estate community