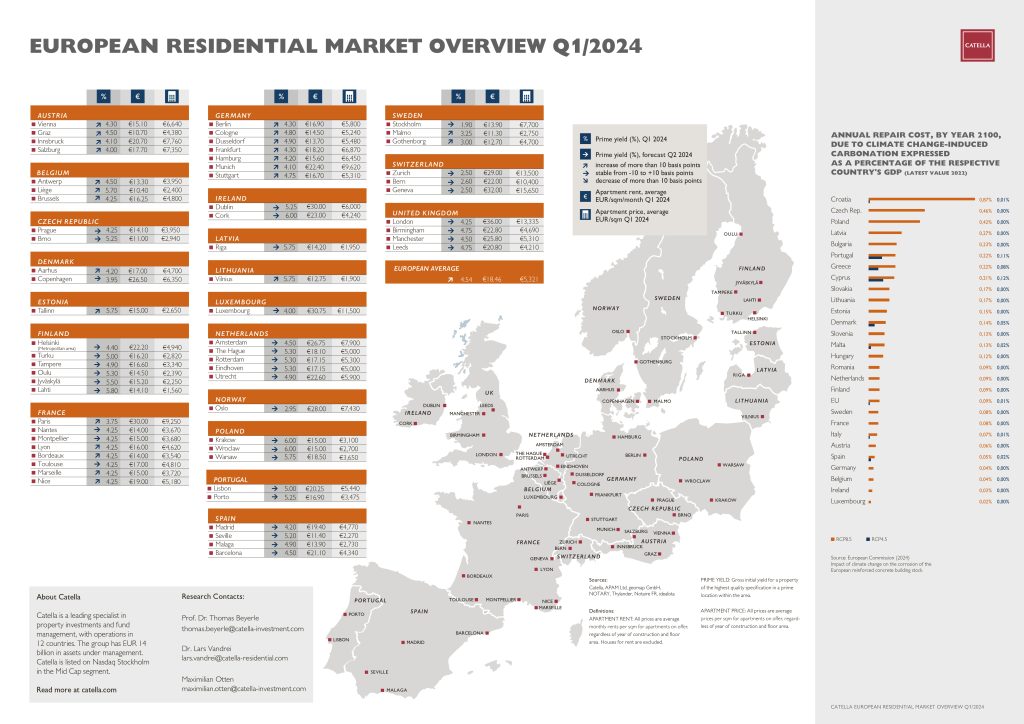

Demand for housing in major European cities and urban centres remains high and is not being met by constrained construction supply, which is continuing to push-up rents. Following the downturn in recent quarters, the price trend for owner-occupied apartments is in a stabilization phase. High inflation is putting pressure on net household incomes and, together with the price trend of recent years and increased financing costs, is making private buyers much more cautious. These are the key findings of the latest Catella Residential Market Overview Q1/ 2024, which analyses the residential markets of 63 cities in 20 European countries.

Prof. Dr Thomas Beyerle, Head of Catella Group Research, said: “After financing conditions stabilized at the end of 2023, demand in the residential property segment is increasing again and prices for owner-occupied apartments have found their bottom. The low level of construction activity throughout Europe means that this trend is likely to continue. Prime yields in some countries, such as Finland and the Netherlands, have peaked for the time being and will move sideways.”

Dr Lars Vandrei, Senior Research Manager at the Catella Group, added: “There is still a significant shortage of new residential construction in major European cities and urban conurbations. Current building permit figures also do not offer much hope of a substantial turnaround in the medium-term. On the contrary, the housing shortage problem is likely to worsen for the time being and rents will continue to rise.”

The Catella Residential Market report detailed below:

Rental market:

- – In 51 of the 63 cities surveyed, residential rents (all years of construction) rose in the first quarter of 2024. The average value is €18.46/m2 per month, 1,6 % higher than in Q3 of 2023.

- – London is at the top of the rent league table at €36.00/m2 (+€2.00/m2 compared to Q3 2023), followed by Geneva at €32.00/m2 (±€0/m2) and Luxembourg at €30.75/m2 (+€0.25/m2).

- – The lowest European rents among the cities surveyed can be found in Liège in Belgium at €10.40/m2 (€0.40/m2) and in Graz in Austria at €10.70/m2 (+€0.20/m2).

- – The strongest growth in rents was recorded in the Irish city of Cork. Here, the average rent rose by €3.60/m2 from €19.40/m2 to €23.00/m2 from Q3 2023. Dublin is the second most dynamic city in terms of European rental growth with

an increase of €3.10/m2 to €30.00/m2.

Property market:

- – European apartment prices have developed very differently. In 34 of the 63 cities surveyed, purchase prices have increased compared with the third quarter of 2023. The average value (all years of construction) is €5,321/m2, 1% higher than in the third quarter of 2023.

- – The highest level by far is still to be found in Geneva, Switzerland, with an average price for an apartment of €15,650/m2 (± €0/m2). Zurich follows in second place at €13,500/m2 (± €0/m2) and London in third place with €13,335/m2 (+€535/m2).

- – You pay the least in Lahti, Finland, among the cities surveyed. Here, the average price for an apartment is €1,560/sqm (-€170/sqm).

Yields:

- – The European prime yield for apartment buildings averaged 4.54% in the first quarter of 2024, 18 basis points higher than in the third quarter of 2023. Only in the Spanish cities of Madrid, Seville and Malaga and in Tallinn, Estonia, did prime yields fall.

- – The lowest yield of all European residential markets can be found in Stockholm at 1.9% (±0 basis points), followed by Zurich and Geneva at 2.5% each (+30 basis points each).

- – Cork in Ireland and Krakow/Wroclaw in Poland currently offers the most attractive prime yields at 6.0 % (+50 basis points), followed by Lahti in Finland at 5.8 % (+40 basis points)

Focus on the German Market:

- – Rents have risen in all of the top seven German cities analysed: Berlin, Düsseldorf,

Frankfurt, Hamburg, Cologne, Munich and Stuttgart between Q3 2023 and Q1

2024.

- – Munich has by far the highest rent level at €22.40/m2 (+€0.70/m2), followed by

Frankfurt at €18.20/m2 (+€0.80/m2).

- – Rents are lowest in Düsseldorf at an average of €13.70/m2 (€0.80/m2).

- – Munich is also at the top of the list of German cities in terms of purchase prices.

An apartment (all years of construction) cost an average of €9,620/m2 (+€250/m2) in the 1st quarter of 2024. This is followed by Frankfurt a.M. with an average price of €6,870/m2 (+€200/m2).

- – At 4.1 % (+30 basis points), the lowest prime yield can be achieved in Munich. Düsseldorf has the most attractive prime yield at 4.9% (+50 basis points).

Climate Change Costs

As a special topic, Catella has taken up the analysis recently published by the European Commission, which quantifies the repair costs of the building stock that will have to be spent to remedy the damages of climate-change induced carbonization. In a ‘business-as- usual’ high greenhouse gas emissions scenario, where average temperatures increase by a projected 4.3 ̊C over pre-industrial levels by the year 2100 (RCP8.5), it is estimated that around €880 billion would have to be spent in the EU countries as a whole. Croatia would be the most affected, with annual expenditure of 0.87% of gross domestic product, followed by the Czech Republic with 0.46% and Poland with 0.42%. Luxembourg (0.02%), Ireland (0.03%), Belgium and Germany (0.04% each) will be the least affected. However, if greenhouse gas emissions can be reduced to a stabilising level (RCP4.5), the total repair costs in the EU are likely to be more than 90% lower.

Source : Catella Residential Investment Management

Le mie ricette per la real estate community

Le mie ricette per la real estate community